Markets Are Reacting. Should You?

It’s all over the news. Footage of missiles lighting up Middle Eastern skies. Long lines of cars fleeing Tehran. Headlines warning of a broader war. It feels big. And it is.

After a surprise Israeli strike on Persian nuclear and military targets, Iran fired back with missile attacks of their own.

Civilians are caught in the crossfire. Families are displaced, and lives are at risk. The situation is tense.1 The human cost is what matters most. Because of the position I'm in, I get questions from people worried about what this means for their financial future.

So while the human cost remains paramount, I also want to address the financial uncertainty many people are feeling. Right now, investors are rattled.

Stocks plunged. Oil spiked. Gold soared. And Wall Street is bracing for more volatility.2

Investors have good reason to be nervous. But history tells us a more interesting story.

Now to be clear… Traders might be right to freak out.

Why? Oil.

A large portion of the world’s oil supply travels through the Strait of Hormuz, a narrow shipping channel off Iran’s southern coast.3 If Iran tries to cut off that route, global energy prices could spike. We’ve seen something like this before. In the 1970s, a Middle East oil shock helped trigger double digit inflation and a brutal market downturn.

But fast forward to today, and things are different. The U.S. is now a major energy exporter.4 Supply chains are more diversified. Markets have more tools and flexibility to adapt.

Of course, when headlines like this dominate the news, it’s easy to feel unsettled. But zooming out helps.

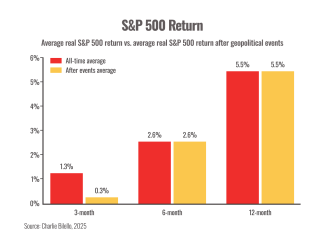

Recently, analysts at J.P. Morgan conducted a study of more than 80 years of geopolitical crises. What did they find?5

- In the first 3 months after a crisis, markets usually dip.

- But after 6 to 12 months, returns tend to bounce back in line with long-term averages.

Of course, history just offers perspective, not predictions. No one knows how this will unfold or how markets will respond. But the data does reveal something interesting… just because markets react fast to geopolitical events doesn’t mean they stay down.

Think of these crises like a smoke alarm going off when you burn your bagel. Loud and jarring? Yes. But not a sign your kitchen’s on fire.

If market reactions to crises tend to be temporary, then what contributes to long-term returns?

Earnings: When companies grow profits, their stock values usually rise. Last quarter, companies in the S&P 500 reported earnings jumped 12% over last year.6

Consumer Confidence: When people feel good about their jobs and finances, they tend to spend more. That spending supports businesses and drives the economy. Lately, consumer confidence has been rising, giving markets another reason to stay resilient.7

Interest Rates: When borrowing gets more expensive, growth can slow down. But if rates stay stable or drop, it opens the door for companies and consumers to spend more. Right now, central banks are playing it cautious and holding steady.8

Inflation: Runaway inflation can hurt everyone. But when it’s under control, it creates a solid foundation for growth. The good news? Inflation has cooled since the pandemic spike. The last reading suggest prices are stable.9

Events like these weigh on all of us - both as human beings concerned about global stability and as investors worried about our financial future.

If your portfolio is built around your goals and properly diversified, it's designed for moments like this.

—----

Sources:

- The Guardian, 2025 [URL: https://www.theguardian.com/world/2025/jun/16/israel-iran-conflict-what-we-know-so-far-explainer]

- Yahoo! Finance, 2025 [URL: https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-futures-slide-as-trump-shakes-hopes-for-an-israel-iran-truce-231426228.html]

- EIA, 2025 [URL: https://www.eia.gov/todayinenergy/detail.php?id=65504#:~:text=Large volumes of oil flow,of global petroleum liquids consumption.]

- EIA, 2024 [URL: https://www.eia.gov/energyexplained/us-energy-facts/imports-and-exports.php]

- JP Morgan, 2025 [URL: https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/how-do-geopolitical-shocks-impact-markets]

- Blackrock, 2025 [URL: https://www.blackrock.com/us/individual/insights/q1-earnings-equity-insights#:~:text=The Q1 2025 earnings season,and sales expanded by 4.4%25.]

- CNBC, 2025 [URL: https://www.cnbc.com/2025/05/27/consumer-confidence-for-may-was-much-stronger-than-expected-on-optimism-for-trade-deals.html]

- CNBC, 2025 [URL: https://www.cnbc.com/2025/06/16/fed-likely-to-hold-interest-rates-steady-what-that-means-for-you.html]

- CNBC, 2025 [URL: https://www.cnbc.com/2025/06/11/cpi-inflation-may-2025.html]

Chart sources:

- JP Morgan, 2025 [URL: https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/how-do-geopolitical-shocks-impact-markets]

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.